SEC opens Capital Raising HUB website

SEC Deputy Director of the Office of the Advocate for Small Business Capital Formation (“OASBCF”) Sebastian Gomez Abero touted the “expanded capital raising pathways” available under the 2012 JOBS Act and urged practitioners to utilize resources now available in the SEC’s consolidated Capital Raising Hub.

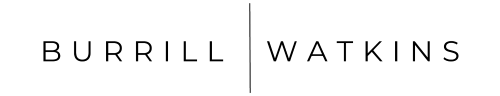

H.R.5376 – Inflation Reduction Act of 2022

(link) https://www.congress.gov/bill/117th-congress/house-bill/5376/text Major Tax Provisions include: The updated draft legislation of the Inflation Reduction Act would include the following major changes, effective beginning after December 31, 2022, unless otherwise noted: Individual Income Taxes Extends the limitation on pass-through business losses enacted in the 2017 Tax Cuts and Jobs Act (TCJA) for two years through 2028. Extends […]

Covid19 SBA Loan/Grant Programs – An Overview for Businesses

There are 3 actions that are being recommended for businesses to consider: 1. SBA Disaster Loans (Apply through SBA website, has $10k emergency grant) 2. SBA Payroll Protection Program (Apply through traditional bank…has 2x monthly payroll available as forgivable grant amount) 3. Ask you banker about expanding your existing lines of credit, or other options […]

CARES Act (S.3548) – there is a lot in here, but these are the business basics and some tips

It was announced over the evening that both parties had come to an agreement regarding the CARES Act for Covid19 relief. There is a ton in the bill, but a relatively small section is devoted to SBA financing support for impacted businesses.

Families First Coronavirus Response Act (“FFCRA”)

The new FFCRA which was signed into law March 18th, 2020 contains two separate laws, the (1) Emergency Family and Medical Leave Expansion Act (“EFMLEA”) and (2) Emergency Paid Sick Leave Act (“EPSLA”), that impose paid family and sick leave obligations on employers with fewer than 500 employees. The Act will go into effect no later than 15 days […]

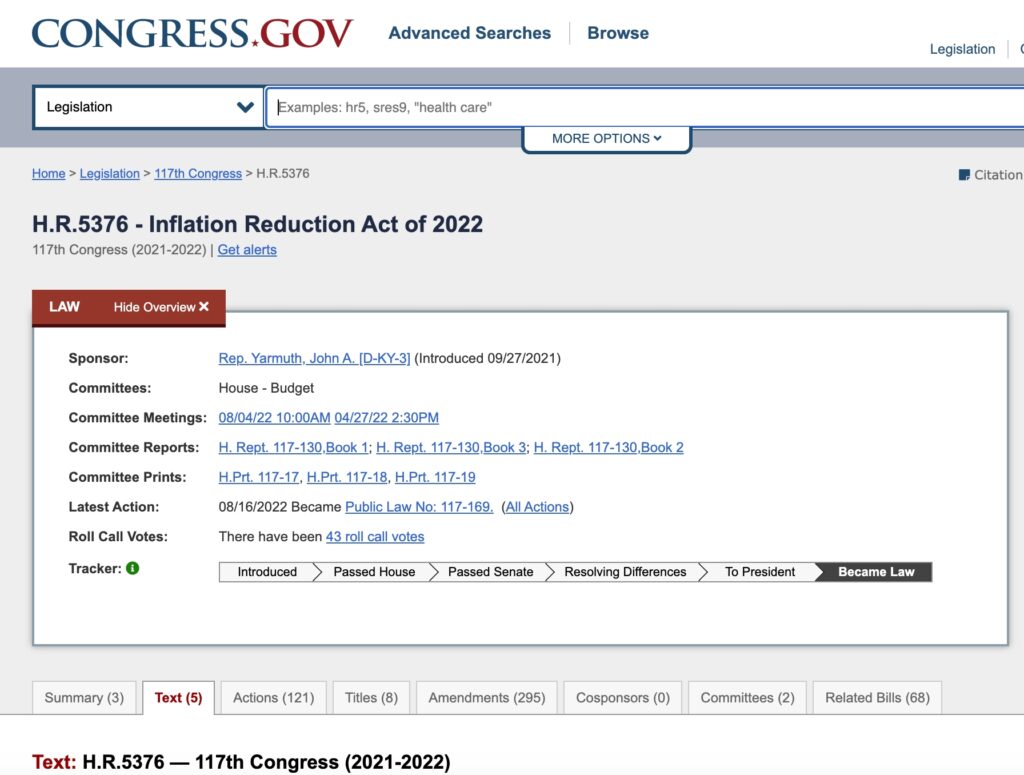

IRS moving Tax Day deadline from April 15 to July 15

In addition to the tax payment deadline that was previously extended, (link – https://www.irs.gov/newsroom/payment-deadline-extended-to-july-15-2020) the IRS announced today that at the President’s direction the IRS is moving Tax Day back from April 15 to July 15.

ORDER OF THE JEFFERSON COUNTY HEALTH OFFICER SUSPENDING CERTAIN PUBLIC GATHERINGS AND CLOSING NONESSENTIAL BUSINESSES AND SERVICES DUE TO RISK OF INFECTION BY COVID-19

For Immediate Release | For More Information, Call Wanda Heard at 205.930.1483 – ORDER OF THE JEFFERSON COUNTY HEALTH OFFICER SUSPENDING CERTAIN PUBLIC GATHERINGS AND CLOSING NONESSENTIAL BUSINESSES AND SERVICES DUE TO RISK OF INFECTION BY COVID-19

All in-person judicial proceedings and appearances in Alabama are suspended for the next 30 days, according to an order by the Alabama State Supreme Court.

The order applies to in-person proceedings in all state and local courts in Alabama: Circuit, district, juvenile, municipal probate and appellate courts.

7 Labor Department Priorities for 2020 (Society for Human Resource Management)

Another year has come to a close and with the dawn of a new year comes the inevitable annual changes to rules and regulation governing our businesses. To help highlight some of the areas to consider, SHRM has given us “7 HR department areas to update in 2020”, including

Did You Know? NASAA Releases New FDD Instructions for 2020

Did you know that last May (2019) that NASAA adopted new state cover sheets and state effective dates page for franchise disclosure documents. Beginning January 1, 2020, any FDD must now include three new cover sheets following the guidelines provided by NASAA.