SEC opens Capital Raising HUB website

SEC Deputy Director of the Office of the Advocate for Small Business Capital Formation (“OASBCF”) Sebastian Gomez Abero touted the “expanded capital raising pathways” available under the 2012 JOBS Act and urged practitioners to utilize resources now available in the SEC’s consolidated Capital Raising Hub.

Covid19 SBA Loan/Grant Programs – An Overview for Businesses

There are 3 actions that are being recommended for businesses to consider: 1. SBA Disaster Loans (Apply through SBA website, has $10k emergency grant) 2. SBA Payroll Protection Program (Apply through traditional bank…has 2x monthly payroll available as forgivable grant amount) 3. Ask you banker about expanding your existing lines of credit, or other options […]

CARES Act (S.3548) – there is a lot in here, but these are the business basics and some tips

It was announced over the evening that both parties had come to an agreement regarding the CARES Act for Covid19 relief. There is a ton in the bill, but a relatively small section is devoted to SBA financing support for impacted businesses.

Gov. Ivey: Alabama small businesses can seek SBA COVID-19 disaster loans

MONTGOMERY – Governor Kay Ivey announced today that small businesses across Alabama negatively impacted by the coronavirus pandemic are eligible for assistance under the U.S. Small Business Administration’s Economic Injury Disaster Loan (EIDL) program.

Families First Coronavirus Response Act (“FFCRA”)

The new FFCRA which was signed into law March 18th, 2020 contains two separate laws, the (1) Emergency Family and Medical Leave Expansion Act (“EFMLEA”) and (2) Emergency Paid Sick Leave Act (“EPSLA”), that impose paid family and sick leave obligations on employers with fewer than 500 employees. The Act will go into effect no later than 15 days […]

IRS moving Tax Day deadline from April 15 to July 15

In addition to the tax payment deadline that was previously extended, (link – https://www.irs.gov/newsroom/payment-deadline-extended-to-july-15-2020) the IRS announced today that at the President’s direction the IRS is moving Tax Day back from April 15 to July 15.

ORDER OF THE JEFFERSON COUNTY HEALTH OFFICER SUSPENDING CERTAIN PUBLIC GATHERINGS AND CLOSING NONESSENTIAL BUSINESSES AND SERVICES DUE TO RISK OF INFECTION BY COVID-19

For Immediate Release | For More Information, Call Wanda Heard at 205.930.1483 – ORDER OF THE JEFFERSON COUNTY HEALTH OFFICER SUSPENDING CERTAIN PUBLIC GATHERINGS AND CLOSING NONESSENTIAL BUSINESSES AND SERVICES DUE TO RISK OF INFECTION BY COVID-19

7 Labor Department Priorities for 2020 (Society for Human Resource Management)

Another year has come to a close and with the dawn of a new year comes the inevitable annual changes to rules and regulation governing our businesses. To help highlight some of the areas to consider, SHRM has given us “7 HR department areas to update in 2020”, including

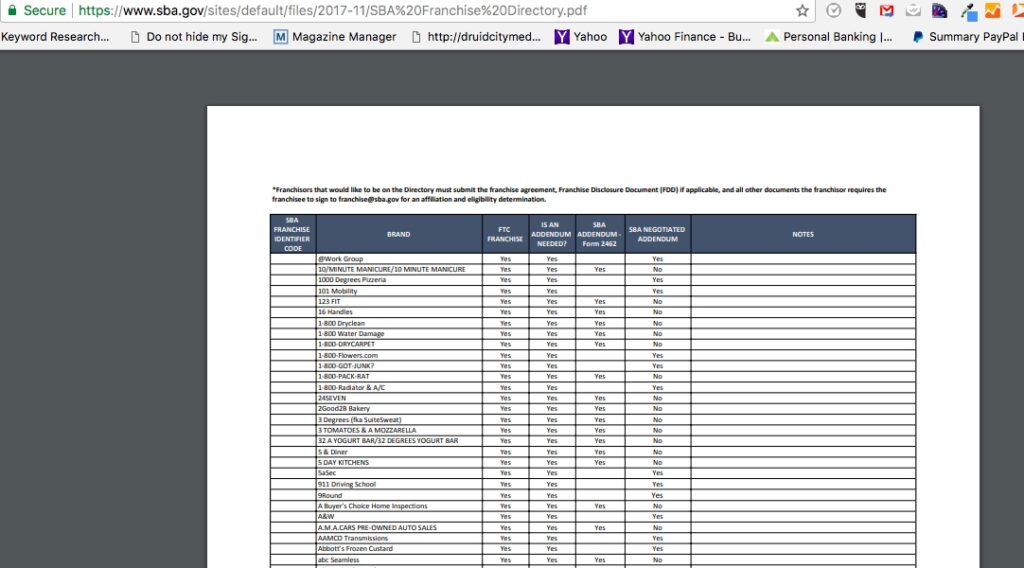

Remember registering a “Franchise” with the SBA is mandatory…at least it is if one plans to use SBA financing.

The U.S. Small Business Administration created the SBA Franchise Directory to try and streamline the process for entrepreneurs looking to access capital. According to SBA Associate Administrator Willam Manger, “It’s a one stop shop to check the growing list of eligible brands for SBA financing. Since its establishment, the Directory and new procedures have received extremely […]

Estate Planning as a Business Owner

A business owner’s estate plan, no matter how complex, can be implemented any time before death, so long as the testator is still legally competent (“sound minded”, including that they understand the nature of making a will, the extent of his/her property, and know who would be considered the natural object of his/her bounty, etc.). Regardless, […]