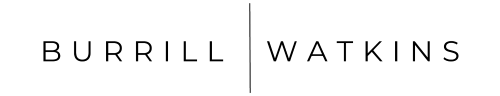

H.R.5376 – Inflation Reduction Act of 2022

(link) https://www.congress.gov/bill/117th-congress/house-bill/5376/text Major Tax Provisions include: The updated draft legislation of the Inflation Reduction Act would include the following major changes, effective beginning after December 31, 2022, unless otherwise noted: Individual Income Taxes Extends the limitation on pass-through business losses enacted in the 2017 Tax Cuts and Jobs Act (TCJA) for two years through 2028. Extends […]

IRS moving Tax Day deadline from April 15 to July 15

In addition to the tax payment deadline that was previously extended, (link – https://www.irs.gov/newsroom/payment-deadline-extended-to-july-15-2020) the IRS announced today that at the President’s direction the IRS is moving Tax Day back from April 15 to July 15.

Year End Planning Tip – Check Your Estate Planning Documents

With the end of the year fast approaching, now is the time to fine tune your estate plan before you get caught up in the chaos of the holiday season. One area that married couples should revisit is their estate planning documents.

ESOPs…is it time to look?

Our main clients are closely held businesses (and their owners), so business and individual planning are often tied at the hip in our office. Often that means a business sale isn’t the ideal exit or retirement solution for our clients, so we look hard for tax advantaged strategies that (at a minimum) won’t hurt the […]

Cash balance plans for professional practices

Cash balance plans offer owner-employees in professional practices a vehicle to defer tax on income well in excess of the annual contribution limits of traditional Sec. 401(k) and profit sharing plans. This option has become increasingly valuable since the total tax burden on owners of unincorporated, flow-through business entities increased in 2013.