Reviewing the U.S. Tax Court ruling in Avrahami v. Commissioner involving an 831(b) captive insurance company.

The U.S. Tax Court recently ruled in Avrahami v. Commissioner, involving a captive insurance company under Section 831(b) of the Internal Revenue Code (IRC).

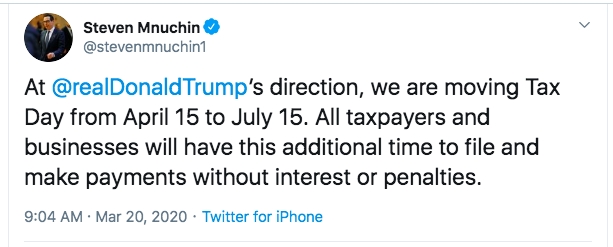

IRS moving Tax Day deadline from April 15 to July 15

In addition to the tax payment deadline that was previously extended, (link – https://www.irs.gov/newsroom/payment-deadline-extended-to-july-15-2020) the IRS announced today that at the President’s direction the IRS is moving Tax Day back from April 15 to July 15.

Year End Planning Tip – Check Your Estate Planning Documents

With the end of the year fast approaching, now is the time to fine tune your estate plan before you get caught up in the chaos of the holiday season. One area that married couples should revisit is their estate planning documents.

Sidestep tax on personal holding companies

The personal holding company tax is often thought to be a remnant of days long gone but it can still come back to haunt business owners. This additional tax can be assessed against a closely held company if it receives excess investment income. However, with some careful tax planning, you may be able to […]

Business Owners May Be Better Off With Solo 401(k) Than SEP IRA

A Simplified Employee Pension Individual Retirement Arrangement (SEP IRA) has traditionally been the most popular retirement plan for the self-employed and small business owner. A SEP IRA is a pure profit sharing plan that allows the employer to make up to a 25% (20% in the case of a sole proprietorship of single member LLC) […]

Cash balance plans for professional practices

Cash balance plans offer owner-employees in professional practices a vehicle to defer tax on income well in excess of the annual contribution limits of traditional Sec. 401(k) and profit sharing plans. This option has become increasingly valuable since the total tax burden on owners of unincorporated, flow-through business entities increased in 2013.