Covid19 SBA Loan/Grant Programs – An Overview for Businesses

There are 3 actions that are being recommended for businesses to consider: 1. SBA Disaster Loans (Apply through SBA website, has $10k emergency grant) 2. SBA Payroll Protection Program (Apply through traditional bank…has 2x monthly payroll available as forgivable grant amount) 3. Ask you banker about expanding your existing lines of credit, or other options […]

CARES Act (S.3548) – there is a lot in here, but these are the business basics and some tips

It was announced over the evening that both parties had come to an agreement regarding the CARES Act for Covid19 relief. There is a ton in the bill, but a relatively small section is devoted to SBA financing support for impacted businesses.

Gov. Ivey: Alabama small businesses can seek SBA COVID-19 disaster loans

MONTGOMERY – Governor Kay Ivey announced today that small businesses across Alabama negatively impacted by the coronavirus pandemic are eligible for assistance under the U.S. Small Business Administration’s Economic Injury Disaster Loan (EIDL) program.

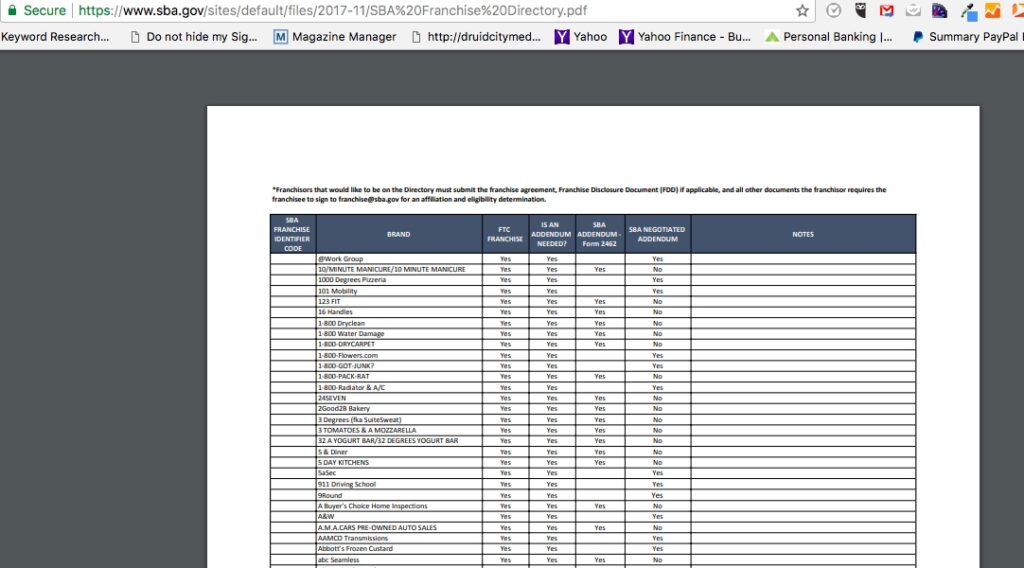

Remember registering a “Franchise” with the SBA is mandatory…at least it is if one plans to use SBA financing.

The U.S. Small Business Administration created the SBA Franchise Directory to try and streamline the process for entrepreneurs looking to access capital. According to SBA Associate Administrator Willam Manger, “It’s a one stop shop to check the growing list of eligible brands for SBA financing. Since its establishment, the Directory and new procedures have received extremely […]