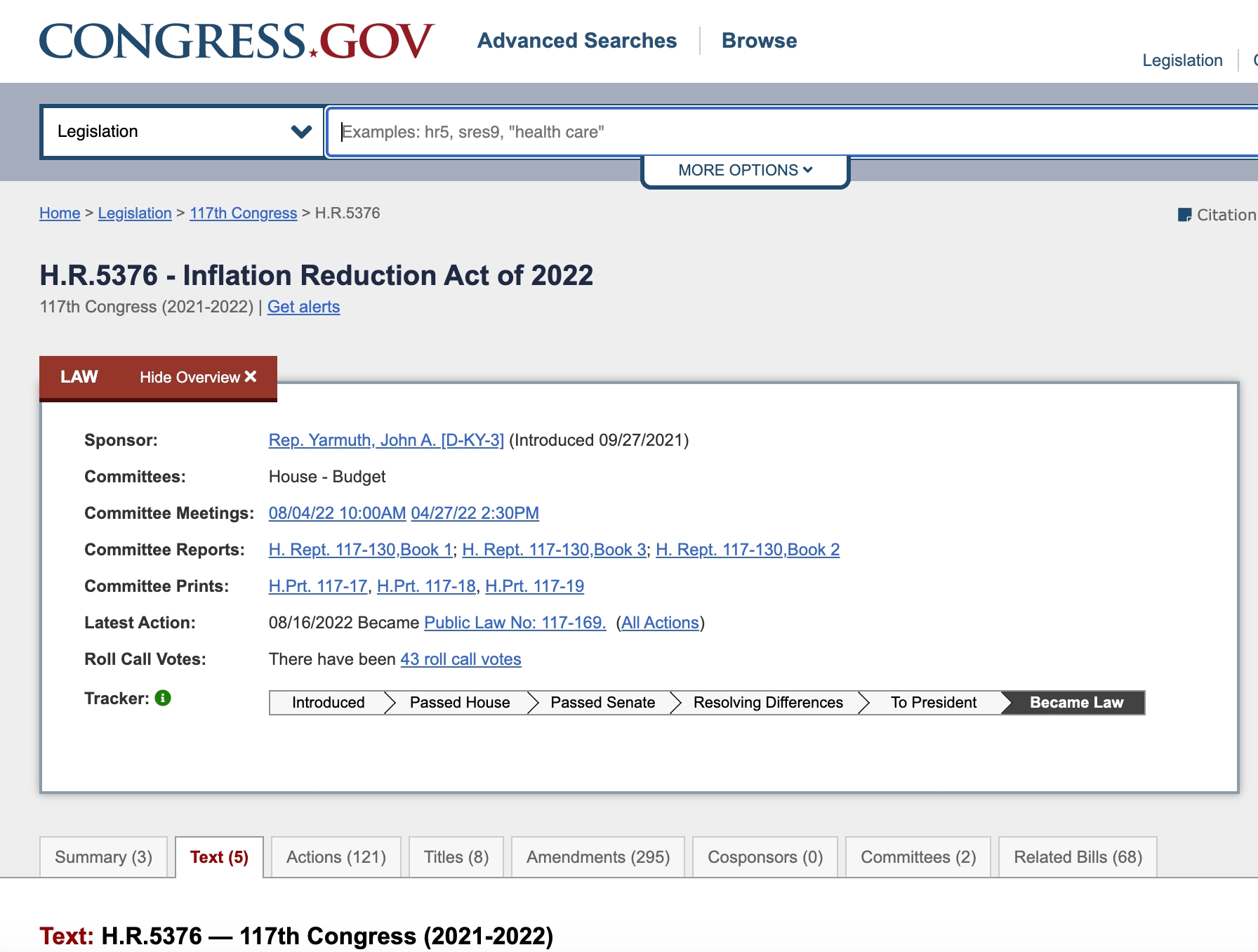

(link) https://www.congress.gov/bill/117th-congress/house-bill/5376/text

(link) https://www.congress.gov/bill/117th-congress/house-bill/5376/text

Major Tax Provisions include:

The updated draft legislation of the Inflation Reduction Act would include the following major changes, effective beginning after December 31, 2022, unless otherwise noted:

Individual Income Taxes

-

Extends the limitation on pass-through business losses enacted in the 2017 Tax Cuts and Jobs Act (TCJA) for two years through 2028.

-

Extends the expanded health insurance Premium Tax Credits provided in the American Rescue Plan Act (ARPA), including allowing higher-income households to qualify for the credits and boosting the subsidy for lower-income households, through the end of 2025.

Corporate and International Taxes

- Imposes a 15 percent minimum tax on corporate book income for corporations with profits over $1 billion, effective for tax years beginning after December 31, 2022.

- Creates a 1 percent excise tax on the value of stock repurchases during the taxable year, net of new issuances of stock, effective for repurchases after December 31, 2022. Excluded from the tax are stock contributed to retirement accounts, pensions, and employee-stock ownership plans (ESOPs).

Other Tax Proposals

- Modifies, extends, and creates a variety of tax credits for green energy and other efforts primarily through 2031 or 2033.

- Raises the Superfund tax on crude oil and imported petroleum to 16.4 cents per barrel (indexed to inflation) and increases other taxes and fees on the fossil fuel sector.

Other Significant Proposals

- Expands IRS enforcement funding by about $80 billion over 10 years.

- Imposes a 95 percent excise tax penalty on drug manufacturers to lower drug prices.

- Increases the research & development tax credit amount that can be claimed against payroll taxes for small businesses by $250,000.