ESOPs are employee stock ownership plans and they have some commonly stated benefits, including:

1. Capital gains tax deferral (IRC Section 1042); *this is the one that gets all the press

2. Tax free income to the ESOP from an S-corp.;

3. Employee motivation and retention; and **this is the one that is often of more interest to our clients

4. Succession planning.

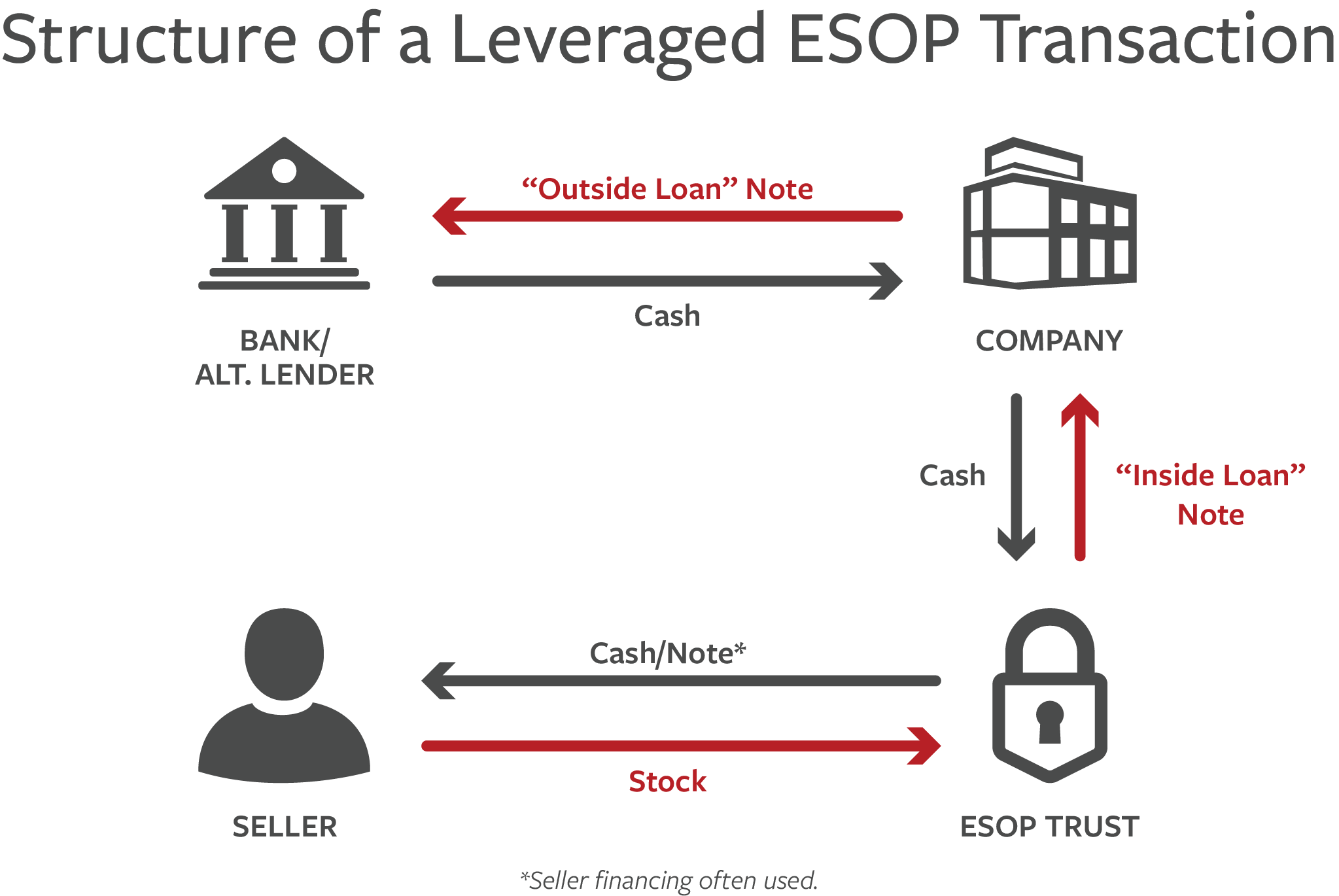

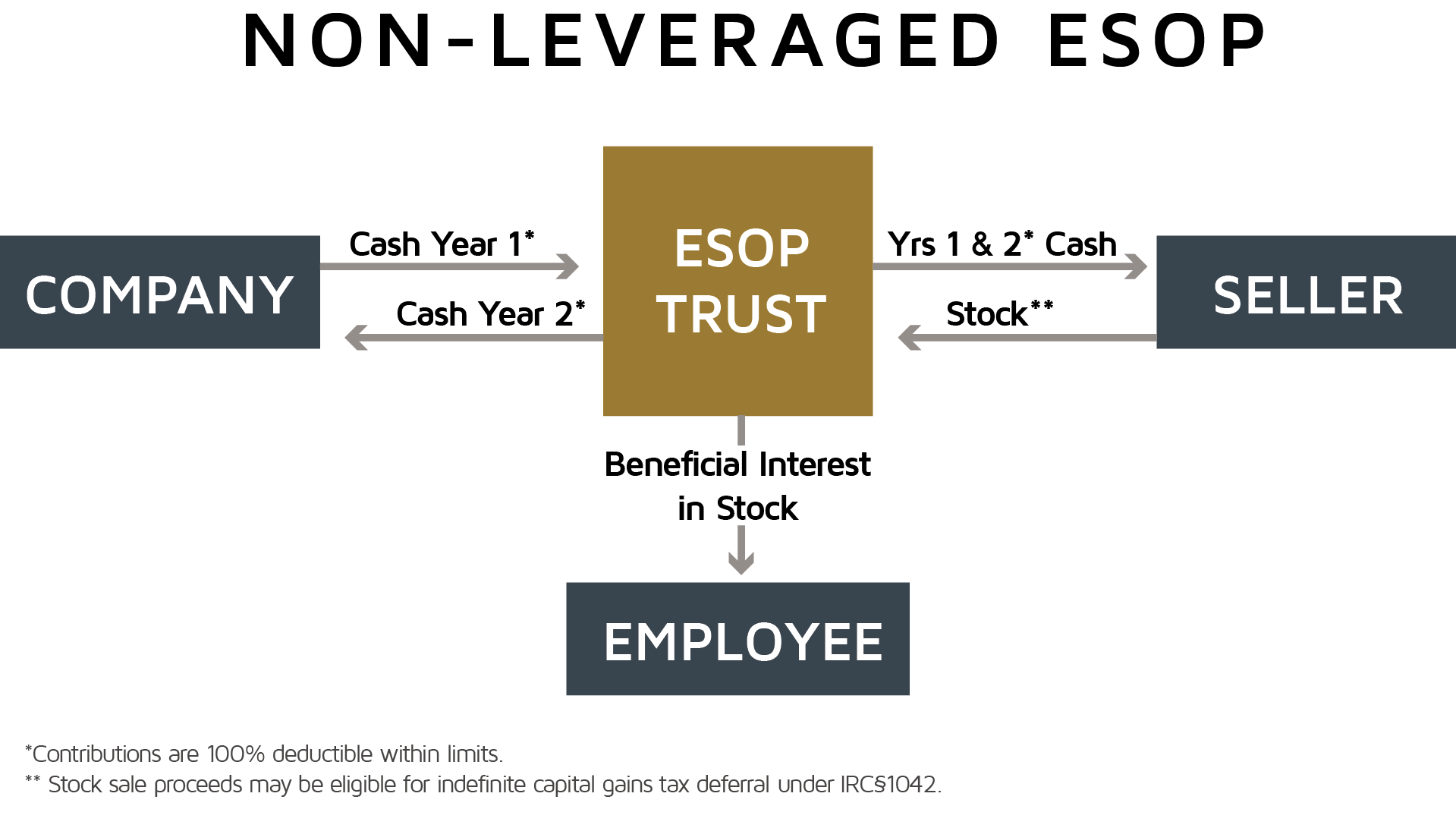

ESOPs have been bounced around in our offices for a long time, but we seem to be finding more situations that fit than in the past. I think that is because in the past, most of our clients were looking at a leveraged ESOP as a tax free exit (#1 above) and often the underlying economics didn’t work (see here), but recently we have had some clients looking at ESOPs for other reasons and the results seem to be more favorable.

There are, of course, a lot of factors to to look at before anyone pulls the trigger on an ESOP, but it looks like we may be seeing more of them in our future and they are definitely something to consider in the right situation.